How Lloyed Lobo Bootstrapped His Way to a $23 Million Exit

- Glenn Grant

- Sep 19, 2023

- 3 min read

In 2017 Lloyed Lobo and his partner, Alex Popa, founded Boast, a software application designed to simplify the process of applying for research and development tax credits.

The bootstrapped company struck a chord with customers that found the process of applying for R&D tax credits cumbersome.

By 2020 Lobo and Popa had built Boast to more than $5 million in revenue when they agreed to a $23 million majority recapitalization from Radian Capital.

In this episode, you’ll discover how to:

Capitalize on the credibility of big-name speakers to elevate your brand.

Digitize a manual service.

Understand your ideal customer profile (ICP).

Leverage events as a marketing channel.

Use a round of growth equity to de-risk yourself (while still playing the long game).

Avoid a single point of failure business model.

Escape the feeling of irrelevance that often accompanies selling your company.

Listen Now

More About Lloyed Lobo

Lloyed Lobo co-founded and successfully bootstrapped Boast.AI, guiding it to achieve eight figures in annual recurring revenue (ARR). Boast.AI is a fintech platform that specializes in offering businesses R&D and innovation funding.

In addition to his work with Boast.AI, Lloyed Lobo also co-founded and bootstrapped Traction, a global community that has reached more than 100,000 entrepreneurs and innovators.

Traction connects leaders from fast-growing companies like Shopify, Atlassian, Twilio, MailChimp, Github, Intercom, Calendly, and Zapier, offering insights on how to build and scale businesses through podcasts, meetups, retreats, and conferences.

Before his ventures with Boast.AI and Traction, Lobo was responsible for product and go-to-market strategies for several early-stage startups. With over 15 years of experience in the US and Canadian startup ecosystems, he has served as an entrepreneur, community builder, and angel investor.

Links & notes

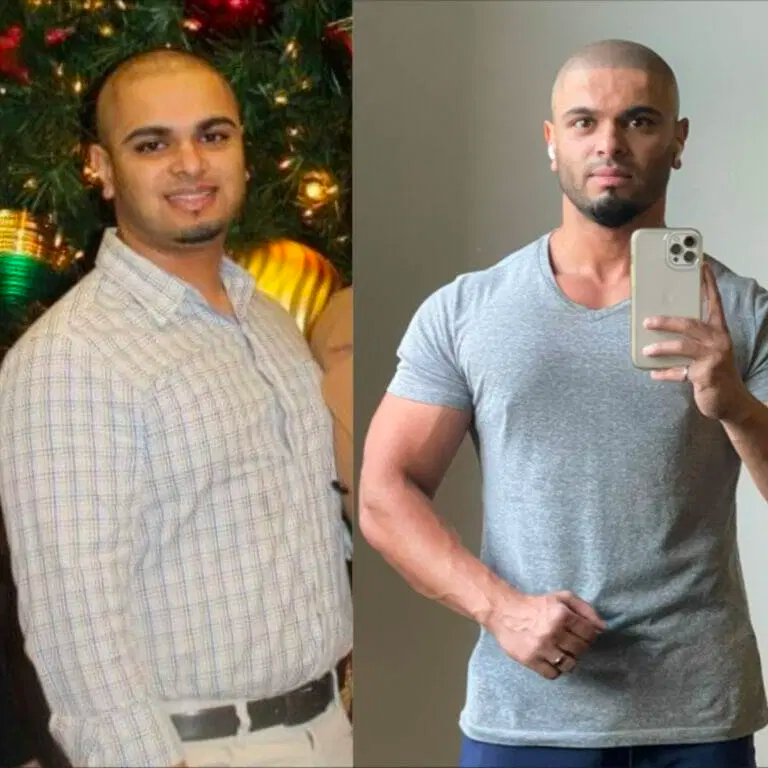

Lloyed’s Before and After Picture

Definitions

Liquidation Preference:

Let’s say you’re at a party, and everyone at the party has chipped in to buy a pizza. But before the pizza arrives, the party gets cancelled. Now, you’d want to make sure you get your share of the money back that was collected for the pizza, right?

In the world of business, a “liquidation preference” is a bit like that. It’s a rule set in a contract that says who gets their money back first if the “party” (in this case, the company) has to shut down and sell off everything it owns.

Usually, this rule is set up to protect the people who took the biggest risk by investing money into the company. These folks usually own something called “preferred stock,” which is a special kind of ownership that comes with some extra privileges. One of those privileges is often a liquidation preference.

So, if the company goes under or is acquired, the people with the liquidation preference (usually the investors or preferred stockholders) get in the front of the line to get their money back. They get paid before anyone else, like employees who own regular shares (“common stock”) or lenders who the company owes money to.

In simple terms, a liquidation preference is like a VIP pass that ensures you get your money back first if a company has to shut down or gets acquired. It’s a way to protect the investment of people who put in money, often at the early stages when the company is most at risk.

Do You Know What the Value of Your Business is?

Take our Value Builder Assessment to get a free estimate of business value and see how your company stacks up against the 8 Key Drivers of Business Value.